charitable gift annuity tax deduction

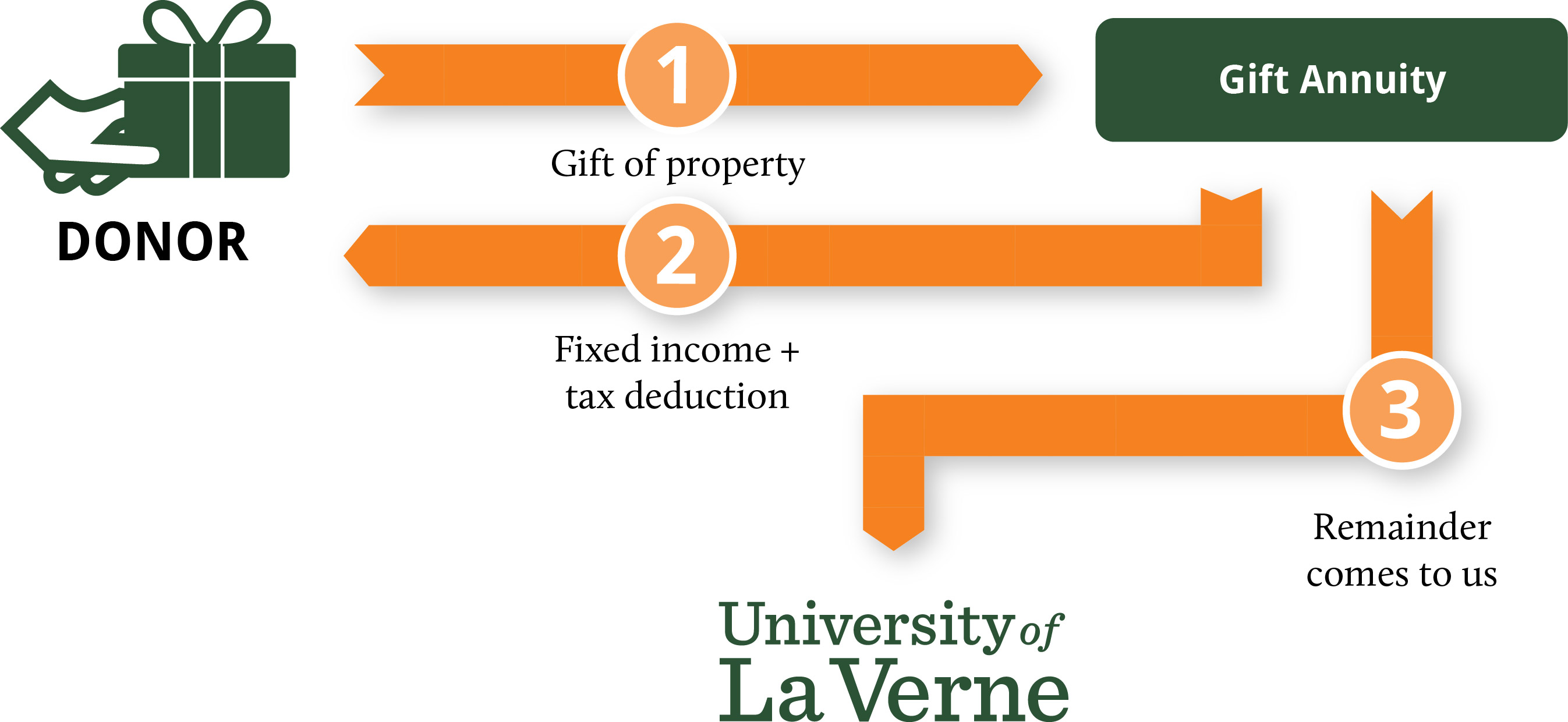

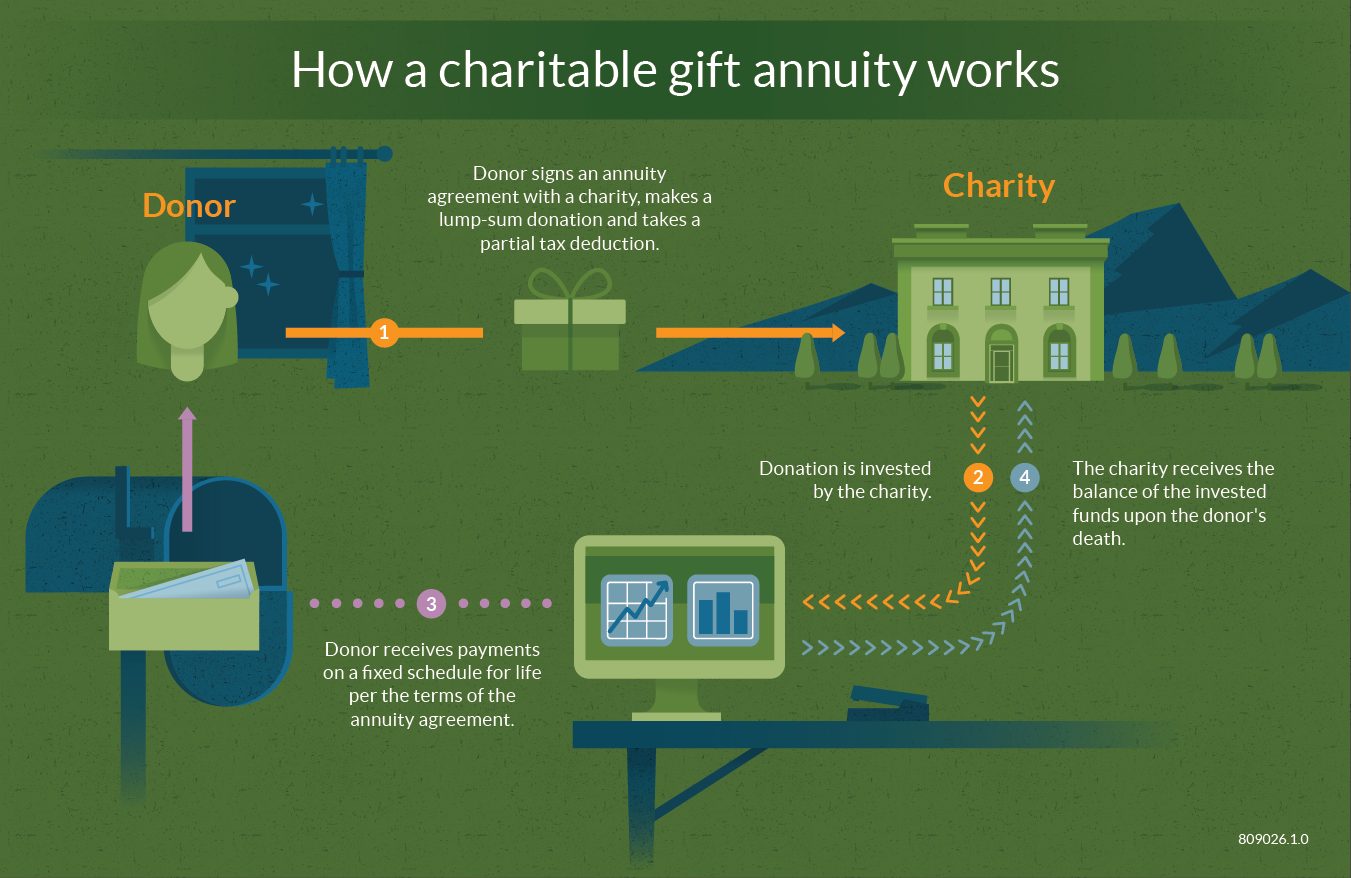

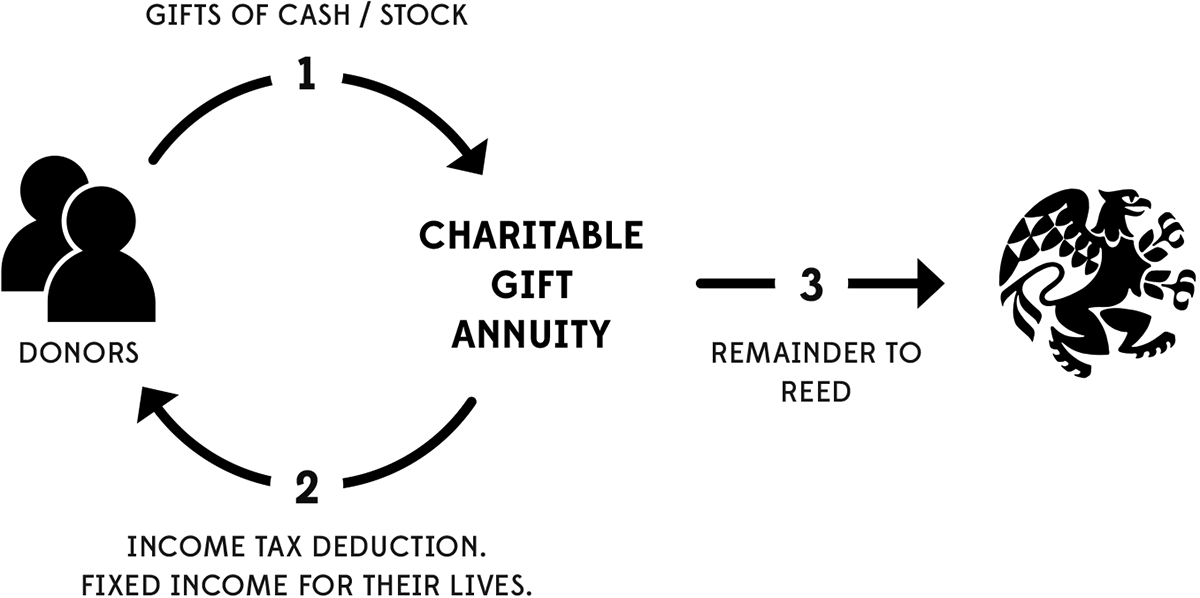

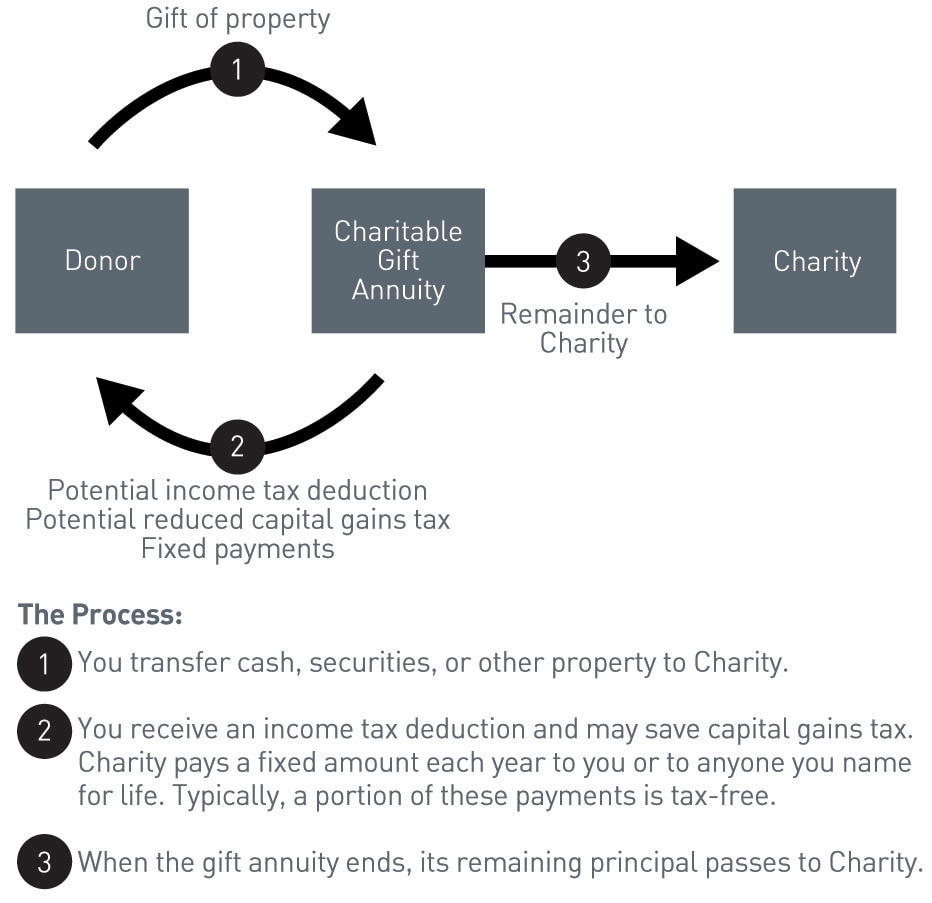

The donor makes a considerable gift to the charity via cash security or other. The lower discount rate assumes the gift assets will only earn 08 annually over the gift term leaving less for charity.

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving

She has 2000000 to invest in the annuity.

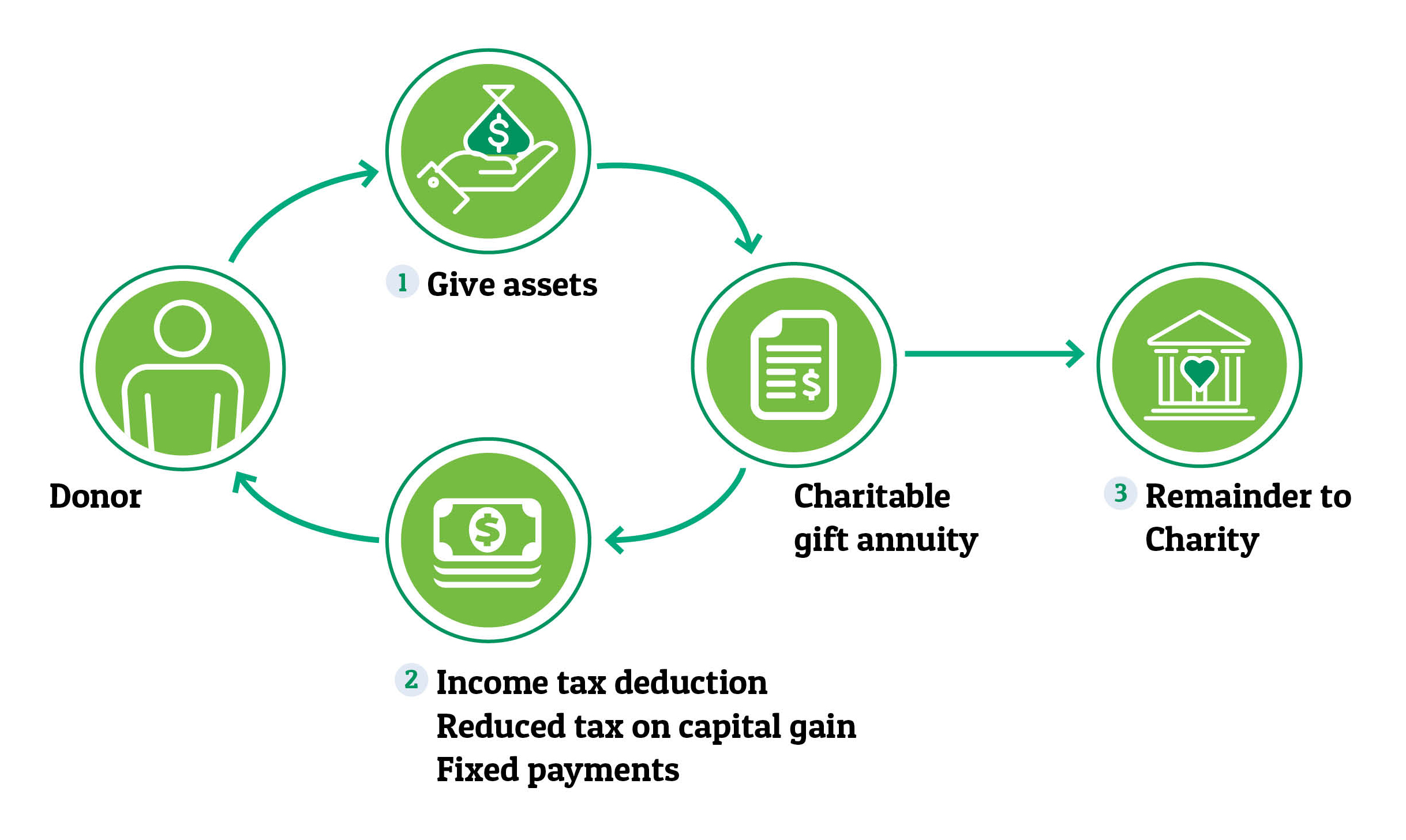

. You may view a unitrust annuity trust gift annuity deferred gift annuity sale and unitrust or gift and sale. Please select a presentation that shows the income and tax benefits for you. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity.

Christophers School that requires a one or two page agreement. You deduct charitable donations in the. For 2013 the ACGA suggests that a 55-year-old be guaranteed a 4 annual return.

A charitable gift annuity is a contract between a donor and a charity with the following terms. A gift annuity is deducted as a charitable donation a component of itemized deductions. You will incur minimal or no costs to establish the.

How Taxes Deductions on Charitable Gift Annuities Work. You paid 100000 for the annuity. Once you transfer assets to create the trust you cannot change your mind and get the assets back.

Theyre also eligible for a federal income tax charitable deduction of 10217. You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid. If there is less for charity the charitable deduction is less.

53808 105 5125. As a donor you make a sizable gift to charity using cash securities or possibly other assets. Download a PDF of this article.

Because it is a charitable gift it generates a charitable income tax deduction for the donor. The Charitable Gift Annuity is at least in part a charitable gift. A charitable gift annuity is a simple arrangement between you and St.

The annual tax-free portion of the 6800 is computed by dividing the cost of the annuity contract 53808 by her life expectancy. A charitable lead annuity trust is an irrevocable arrangement. That is a portion may.

The income tax charitable deduction for a gift annuity is less than the amount of the gift donated. So for 100000 of stock Pomona can give you an annuity ostensibly worth no more than. Donors benefit from the purchase of a charitable gift annuity because they get an immediate tax deduction as well as future payments.

Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time. As with any other. Jones also desires to make a gift to her favorite charity.

A charitable gift annuity is a contract between a charity and a donor bound by some terms explained below. They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000. Charitable Gift Annuity.

The tax code mandates that the college retain a back end worth at least 10 of the deal. At age 65 the rate is 47 and at age 70 it goes up to 51. If you and your spouse create a gift annuity.

This portion of her. Substantiation required by the Internal Revenue Service for a taxpayer to claim a. It will pay her 800000 a year or 40 a year for the rest of her life.

A charitable gift annuity is a contract between a charity and a donor where in exchange for an irrevocable transfer of assets to the charity the donor receives. January 28 2020 659 AM. However unlike other forms of.

A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. The charity benefits because when the annuitant dies it. A charitable gift annuity CGA is a contract under which a 501c3 qualified public charity in return for an irrevocable transfer of cash or other.

What Is A Charitable Gift Annuity Fidelity Charitable

Life Income Gifts Giving To Reed Reed College

Charitable Gift Annuity National Gift Annuity Foundation

Turn Your Generosity Into Lifetime Income Los Angeles Jewish Health

Planned Giving 101 Charitable Gift Annuities Agfinancial

Pet Therapy Charitable Gift Annuity Lifelong Pet Care

Charitable Gift Annuities Development Alumni Relations

Deferred Charitable Gift Annuity Planned Giving Case Western Reserve University

Abcs Of Cgas Basics Of Charitable Gift Annuities Gordon Fischer Law Firm

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

Taxation Of Charitable Gift Annuities 1 Calculating The Deduction Youtube

Charitable Gift Annuity Texas A M Foundation

City Of Hope Planned Giving Annuity

Charitable Gift Annuities National Wildlife Federation

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Charitable Gift Annuity Airport Marina Counseling Service

What Is A Charitable Gift Annuity Youtube

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact